Articles

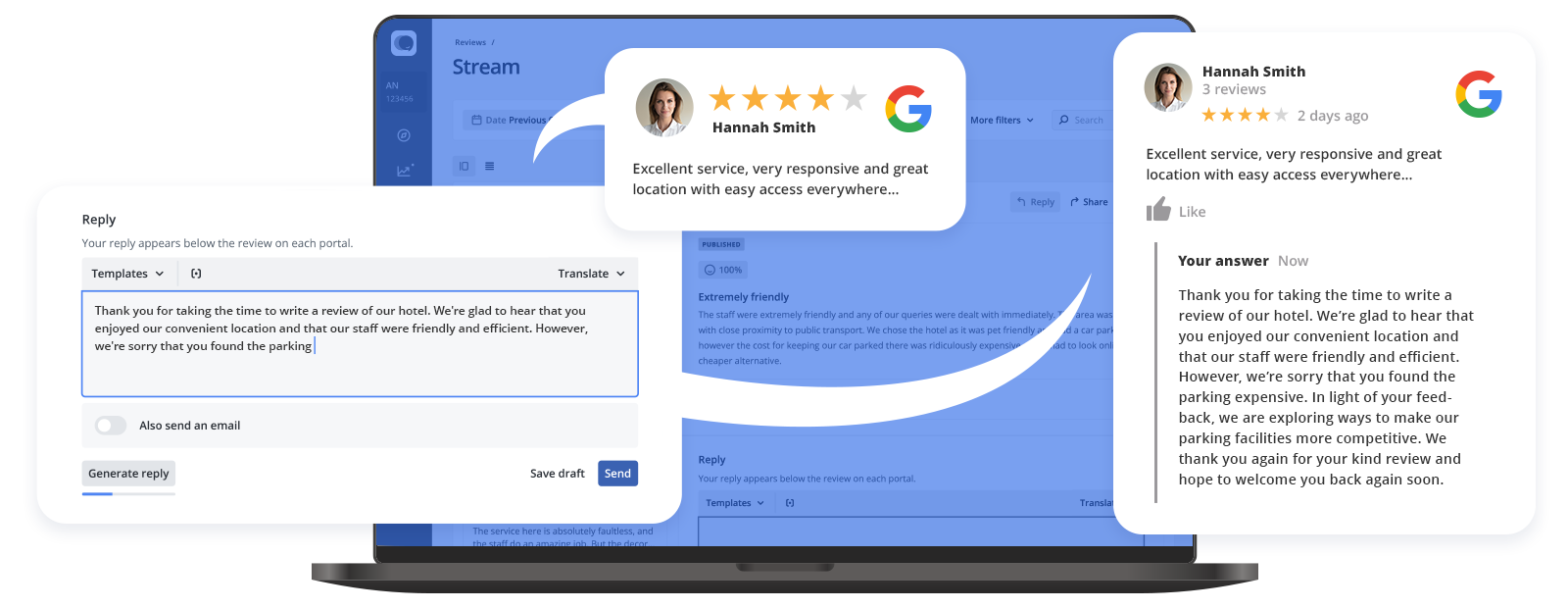

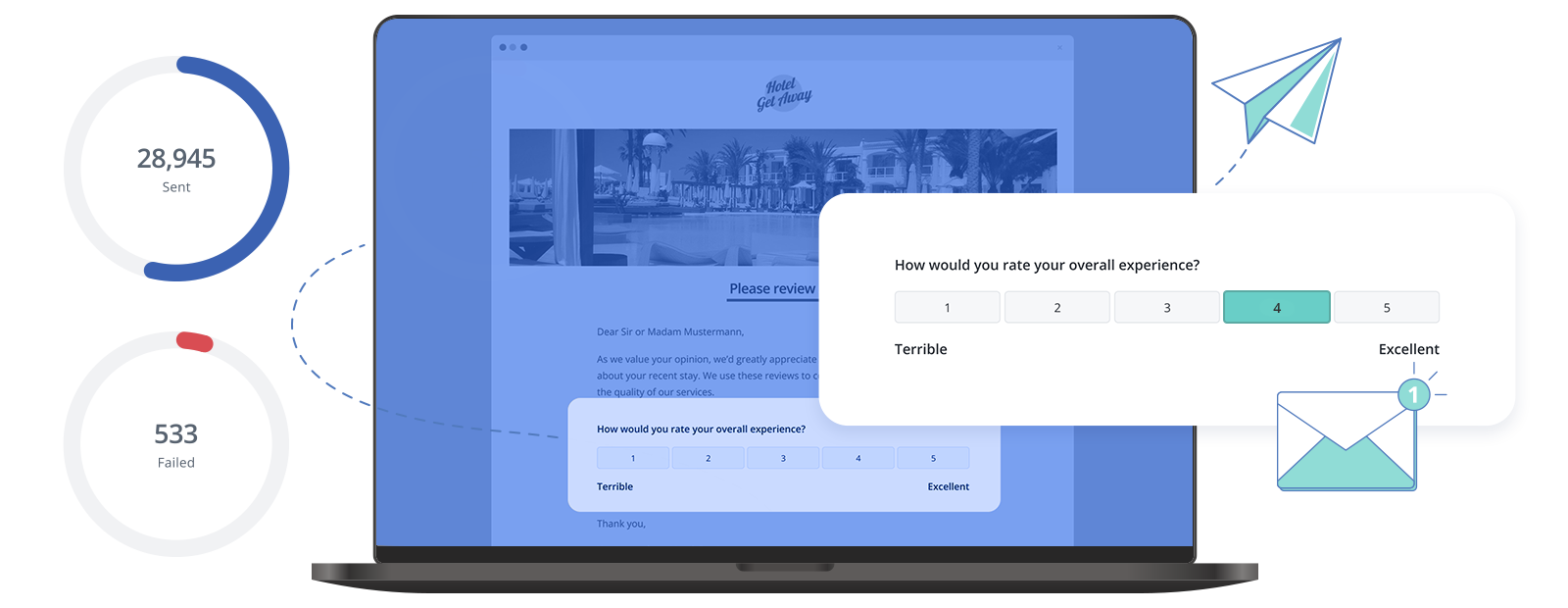

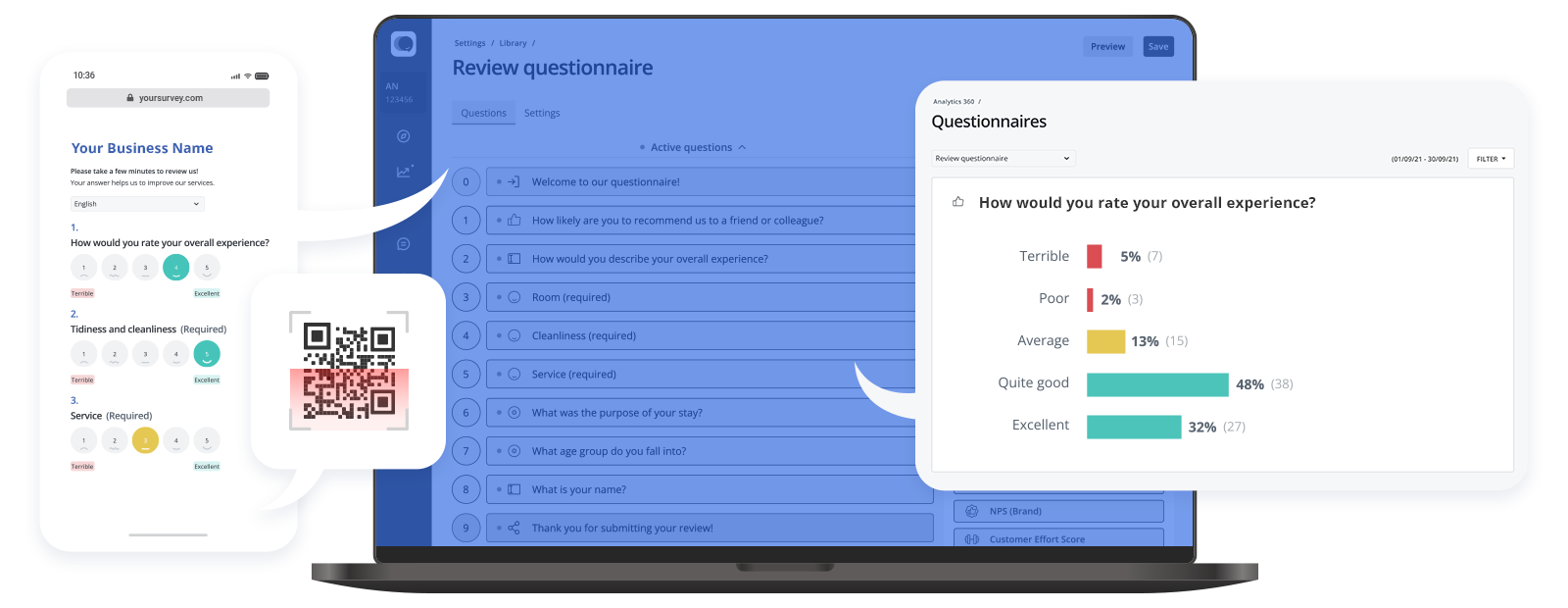

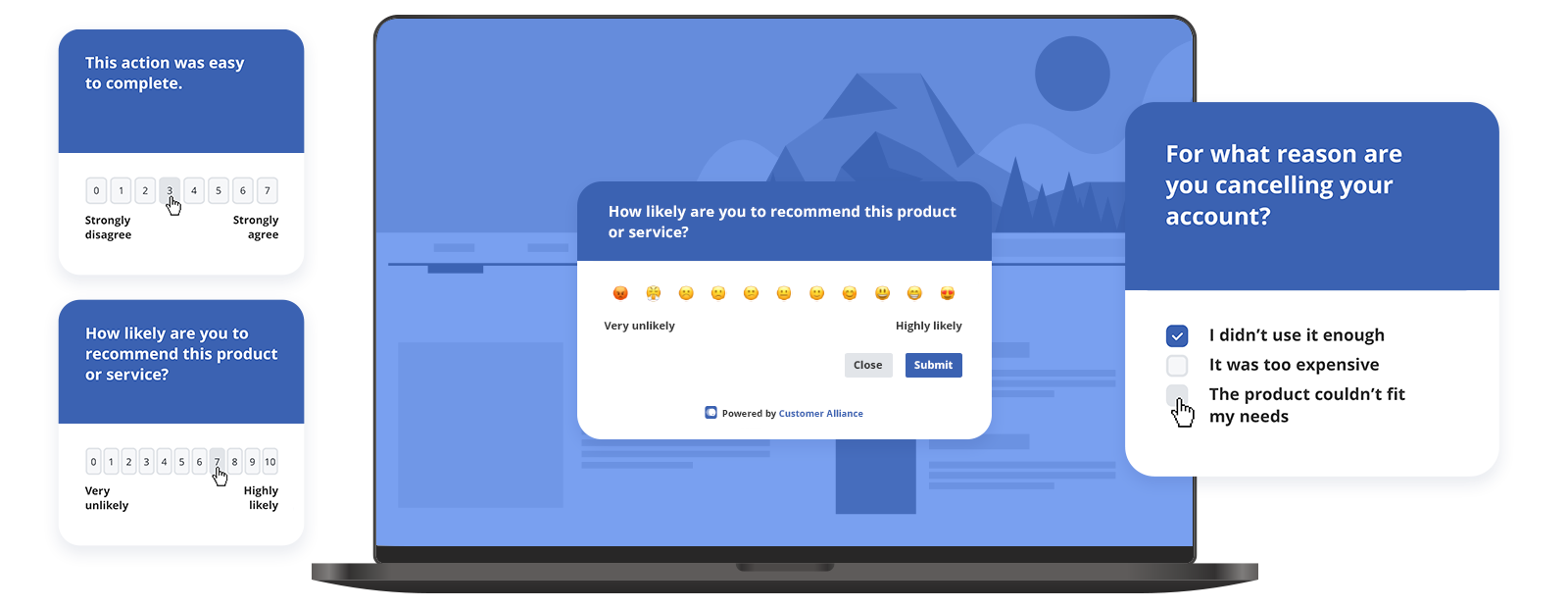

Managing online reviews: a step-by-step guide [+ free template]

Review management has the power to increase your online visibility, set you apart from the competition, and attract more customers. But when you’re faced with a

[Calculator] How a one-point increase in your TripAdvisor rating boosts hotel revenue

With close to 150 million visitors every month, TripAdvisor is one of the world’s biggest travel websites.But despite a huge potential audience, you might wonder

Online review survey 2024 [statistics every marketer should know]

Your customers are talking. Are you listening? In our survey of 750 people across Germany, Austria, Switzerland, France, and Italy, we uncovered how significantly online

Does responding to reviews help SEO?

Picture settling into your office chair on a Monday morning, your cup of coffee steaming beside your computer. You start your week by scrolling through