The importance of customer service in banking and financial services

When it comes to which company we choose to look after our money, there have never been more options. While customers simply used to open an account with their nearest branch, today there are plenty of choices (including online and mobile banks) with new offerings springing up every year. So how can modern banks stand out from the crowd?

In banking, there are limited ways you can differentiate your service. Thanks to the nature of the industry, almost every business offers similar products, and regulations often mean there is not much room to compete on price. However, customer service is an area where banks can really shine.

The importance of an excellent customer experience in banking can’t be understated. After all, finances are an extremely personal topic for most people. Customers want to feel that they matter and their money is being well taken care of.

With that in mind, here are six ways you can improve customer service in banking and financial services. Go ahead and click on any of the links and you’ll be taken straight to that section.

1. Gather data from your existing customers

To improve your customer service, the first step is to be crystal clear on how things currently stand. Fortunately, you have a wealth of amazing resources at your fingertips. Who better to ask about your customer service than the customers you already have?

When you make the effort to ask, you may be surprised at just how many of your customers are happy to share their views. In fact, 77% of customers view companies more favourably if they ask for and apply customer feedback (1). There are a number of different methods you can use to collect feedback and improve customer service in banking. Here are a few of the most effective.

Surveys

Today, surveys can be carried out in tons of different ways. Chatbots, SMS, emails, QR codes make it more convenient than ever for customers to share their feedback with just a few taps.

This technology allows you to capture feedback in real-time, for instance when a customer has just spoken to an advisor online or visited a branch. So if you’re not making the most of it, then it’s about time you start!

Capturing their thoughts and feelings while the experience is still fresh in their minds can help you get more authentic feedback and a better grasp on customer satisfaction. However, sending surveys at any time will be hugely beneficial for gaining key customer insights.

Interviews

Whether carried out in-person or via video call, interviews can help you get a more in-depth look into your customer feedback. Rather than working only with a set list of questions, the interview format allows you to dive deeper into any specific points of interest and gives the customer more freedom to express themselves. Interview transcripts can also be made and analysed for sentiment, giving you even more information to work with.

Reviews

While reviews are primarily seen as a tool for other prospective customers, they can also be highly valuable in gleaning feedback for your company. When leaving a review, a customer is given free rein to share their honest opinion without the restrictions of pre-selected questions.

As a result, reviews can even bring things to your attention that you might not have otherwise been aware of. Reviews are another feedback tool where semantics analysis can be used to allow for greater customer insight.

2. Map out your customer journey

[ca-form id=”194451″ align=”left” var1=”https://www.customer-alliance.com/wp-content/uploads/2022/05/customer-alliance-customer-satisfaction-in-banking-guide-download.pdf”]

Customer journey mapping is an insightful tool that pinpoints the series of events a customer goes through when experiencing your products. It clarifies their goals, the emotions they feel and any pain points or hesitations they encounter along the way.

By mapping out these events (known as touchpoints) you can understand your customers better. Not only that, but you can pinpoint areas where you can improve customer service in banking. Creating a customer journey map is a fairly in-depth process, but one that will hugely benefit your organisation. It starts with identifying your customer persona.

Almost all banking and financial institutions will have many different customer personas. For example, you may have personal bankers, business bankers and prospective homeowners looking for a mortgage. To start with, it’s a good idea to focus on just a couple of the most common personas and deal with them one at a time. As you grow your customer experience strategy, you can gradually add more customer journeys.

From there, you will detail each touchpoint your customer encounters, including everything from seeing an advert for your bank online to taking out a loan. Using real customer data, you can get clarity on how your customers feel at each and every one. You can also work out what’s stopping them from moving onto the next phase of the journey.

Pain points that impact customer experience in banking

The potential problems you encounter in your map are often referred to as customer pain points. These pain points can be extremely diverse, and some will have a bigger impact on the customer journey than others. However, in banking and financial services, there are a few key areas where you may want to focus your attention.

- Onboarding – Take a look at your processes for opening a new account or taking out a new product. How many steps are there? Do customers need to provide the same information more than once? Do they need to use multiple different channels to complete the process? Look for areas where you can simplify and improve the customer experience

- Authentication – How easy is it for customers to access their accounts? While authentication should be secure, it should also be straightforward and not require too many passwords and PINs. A balance between security and convenience is essential here.

- Navigation – Your customers should be able to easily find what they are looking on your website and app. The navigation should always be designed according to the customer’s needs, using a simple layout and clear, descriptive labels.

- Customer service – If a customer has an issue, it should be immediately clear how they can contact customer service. Ideally, there should also be different channels available for doing so (email, phone, live chat etc).

Once you start working through your customer journey map, you will likely identify various other areas with customer pain points. However, this list should give you a good place to start.

If you’d like to create a customer journey map, you can find more information and a step-by-step guide here: How a Customer Journey Map Helps you Offer Unique Experiences

3. Measure and monitor current customer satisfaction

Collecting feedback can go a long way in helping make more confident business decisions. But when it comes to customer satisfaction, how do you get the most accurate insight into your performance? This is where customer satisfaction metrics are invaluable.

Rather than provide you with a broad sense of your customers’ overall happiness, these methods give you an actual score to work with. Having a concrete figure allows you to monitor your customer satisfaction over time.

The quality of your customer service is directly linked to customer satisfaction, and knowing your numbers enables you to act fast if things begin to slip. Again, you have a few options here. Let’s take a look at the most commonly used.

Net Promoter Score (NPS)

Simply put, the Net Promoter Score is a measure of customer loyalty. This method asks people how likely they are to recommend your company to others on a scale of 1 to 10. The responses are then used to group your customers into one of three categories:

- Promoters, enthusiast customers who will continue to use your services and promote them to others

- Passives, who are satisfied with your service but may be vulnerable to competitors

- Detractors, unhappy customers who may share negative feedback with others (and might be ready to jump ship)

Your overall Net Promoter Score is simply calculated by subtracting the percentage of detractors from the percentage of promoters.

It sounds simple, and it is. But don’t be fooled. Your NPS can have a huge impact on your company’s future success. Consider this: Only 31% of banking customers are promoters (2). Work on improving your score and you will immediately be ahead of the pack.

Customer Satisfaction Score (CSAT)

Like NPS, the Customer Satisfaction Score also uses a rating system numbered from 1 to 5 (very dissatisfied to very satisfied). However, CSAT is used to measure customer satisfaction after one interaction as opposed to customer satisfaction over time. This method is most commonly used after a customer engages directly with service staff, although its versatility allows it to be used in a wide range of different scenarios.

For example, say a banking customer had a question about their account and chose to speak to customer service via live chat on their banking app. At the end of that chat, a question could be: “How would you rate your recent experience with our Support Team?”

The CSAT can then be calculated in two ways. You can find an average of the scores given, or you can work out the percentage of those who answered with a 4 or 5 (satisfied and very satisfied).

NPS and CSAT are two of the most commonly used methods for measuring customer satisfaction. However, there are several other metrics that you can use. For a more in-depth look at them, you may like to download our handy guide, ‘How to measure customer satisfaction KPI: NPS, CSAT, CES, & CLI‘.

4. Analyse your data (and determine satisfaction drivers)

Analysing the information you gather is key to improving customer service in banking. Are there certain words or topics that come up time and time again? Do certain branches consistently perform worse or better than others? Are particular areas of your service bringing your scores down? These are all the kinds of questions you need to answer.

Where generating feedback gives you an idea of how satisfied your customers are, analysis helps you understand why. Part of this is identifying your customer satisfaction drivers.

When you know what drives satisfaction, you can prioritise those areas and improve your service to really impress your customers. This may seem hard to achieve, but it doesn’t need to be. Even small gestures like rewarding loyalty with lower fees or offering a cash incentive for new accounts can go a long way in enhancing the customer experience.

Similarly, when you know what drives dissatisfaction for your clients, you are better primed to take action. Rather than guessing at ways you can improve, using real data to inform your decisions will bring you much better results.

5. Respond to (and resolve) individual customer feedback

Customer service in banking (or any industry, for that matter) isn’t always perfect. Even with your best efforts, you’re always going to have some customers who are unhappy with their experience. While some will simply take their banking needs elsewhere, others will make their feedback known. Some will choose to do so on a public review platform.

The way you respond to this feedback can have a huge impact on your business. Why? Trust is an essential ingredient to customer satisfaction in banking. Crafting genuine, replies to reviews is one way of showing your customers that you care. This goes a long way in building the trust you need to create loyal customers and improve the customer experience in banking.

Responding to reviews, both positive and negative, holds tons of benefits for your business and online reputation. It can:

- Increase the number of reviews you receive, giving you even more valuable data to work with

- Prevent further negative reviews because people can see prior solutions for complaints similar to their own

- Stop you losing a customer by offering a solution to their problem (that you might not otherwise have known about)

- Change a potential customer’s perceptions of your bank or financial institution

- Help build relationships and show support to your existing customers

6. Implement customer feedback software

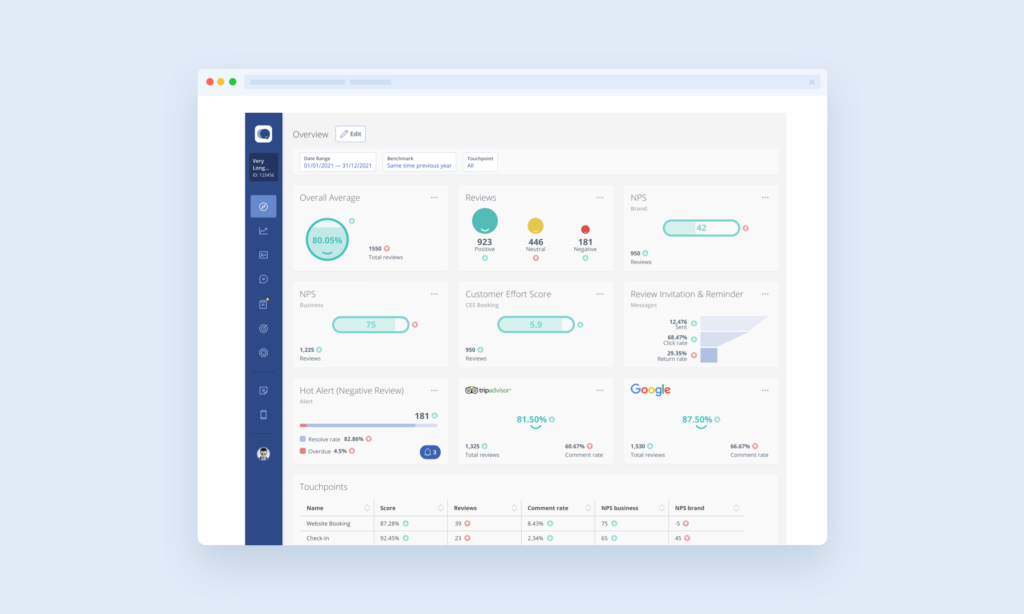

As we’ve illustrated throughout this article, collecting and analysing data is at the heart of improving customer service in banking. However, streamlining the process for even one location, let alone across different branches, is a big task. That’s why a Voice of the Customer platform is an invaluable asset for improved customer experience management.

For instance, think about our point of responding to customer feedback. If you get multiple new reviews each day for each of your branches, how will you make sure they each receive a response? Sure, you could manually check all the different review platforms each day. But who has time for that?

Here are a few of the tasks that the right software can take care of for you:

- Automatically send surveys designed to fit your business and customer needs

- Calculate and monitor the customer satisfaction metrics we described up above

- Collect more customer reviews, distribute them to the most important online platforms for your industry and display them on your website

- Analyse those reviews for semantics to better understand how your customers feel about your products and service

- Quickly and easily create reports that you can share across your company

And that is just the tip of the iceberg. With good customer feedback software in place, you are well-positioned to not only drastically improve customer service in banking but offer outstanding experiences to your customers.

The impact of excellent customer service in banking

What are the end goals for better customer service? We know that it is intrinsically linked to higher levels of customer satisfaction, but there are also tangible business goals that enhanced service can help to achieve. Let’s take a look at a few of them.

Lessen customer churn

A study from Temkin showed that 69% of customers who plan to leave their bank say the decision was down to poor service (3). And once a customer leaves, there’s nowhere else for them to go except straight to your competitors. By making efforts to better your customer service, you’ll make it easier to remedy customers’ problems before it’s too late.

Reduce costs

Did you know it’s 5x to 25x more expensive to obtain a new customer than it is to keep a current one (4)? A secondary benefit of reducing churn is the money you’ll save attracting new customers to your bank. Focussing more effort on your existing customers will have an undeniable impact on your bottom line.

Increase number of promoters

As we touched on earlier, your Net Promoter Score gives you a good indicator of customer loyalty. Those who give the highest scores are categorised as ‘promoters’ and essentially act as brand ambassadors, recommending your product to others. The better your service, the more promoters you are likely to have, and the more they will promote your business.

Boost product uptake

Banking customers will likely seek out numerous different products throughout their lifetime. They may start with a basic account, but what happens when they want a credit card, a personal loan or a mortgage? When you deliver excellent customer service, you give them fewer reasons to look elsewhere.

Conclusion

At its core, improving customer service starts with gaining a deep understanding of your customers want and needs. And to really tap into what drives your customers, you need to have good systems in place. Using the right tools will allow you to:

- Collect customer feedback and insights at the most important customer touchpoints

- Create robust feedback loops across multiple channels

- Get accurate, in-depth insight into your data through analysis and reporting

Once you do this, you can create an exceptional customer experience, drive customer loyalty and bring about both short and long-term rewards for your business. If you’d like to discover how to achieve this in your bank or financial institution, why not schedule a no-obligation, free demo of our Voice of the Customer platform?

Sources:

- Microsoft 2017 State of Global Customer Service Report

- Temkin 2018 Experience Ratings

- Temkin 2018 Experience Ratings

- Bain & Company. Report: Prescription for cutting costs